38+ how does a reverse mortgage loan work

Web A reverse mortgage can be an expensive way to borrow. Web A reverse mortgage is a loan for homeowners 62 and up with a large amount of home equity.

:max_bytes(150000):strip_icc()/fontinelle-5bfc262a46e0fb0083bf8446.jpg)

Reverse Mortgage Guide With Types And Requirements

Web A reverse mortgage is a loan based on the paid-up current value or equity in your home.

. The annual cost of your mortgage insurance premium is 05 of your total mortgage balance for an HECM. The lender will typically be able to tell you what you can expect for loan amounts fees. Below are the basic eligibility requirements.

Web Three days before the closing the lender is required to send you the Closing Disclosure. Web If you get a reverse mortgage through the HECM program your loan amount will depend on your homes value its sale price or the FHA mortgage limit 625500. Is it right for you now.

Web A reverse mortgage is a loan that allows homeowners who are 62 or older borrow against a portion of the equity in their home. Web Up to 25 cash back In a traditional forward mortgage a borrower takes out a lump sum of money and steadily repays the lender over time like 30 years usually by making monthly. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Ad Compare the Best Reverse Mortgage Lenders. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. The homeowner can borrow money from a lender against the value of their home.

Web With a reverse mortgage loan the amount the homeowner owes to the lender goes upnot downover time. Web The borrower must pay an initial one-time premium for the FHA insurance equal to 2 of the loan amount. For Homeowners Age 61.

It should be almost the same with the Loan Estimate you received at the. A younger retiree can stay in the house while turning equity into an income stream Craig Lemoine the. This is because interest and fees are added to the.

Web Mortgage insurance payments. For Homeowners Age 61. Find Out In Less Than 2 Minutes If A Reverse Mortgage Is Right For You.

Unlike a conventional mortgage your lender pays you in monthly. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Ad Can the loan improve your emotional and financial well being. An Overview Of Reverse Mortgage And How It Works. The youngest borrower on title must be 62 years of age or older.

Read more Not everyone is eligible for a reverse mortgage Along with age there are a. Web 1 day agoAs the name suggests reverse mortgages work like a regular mortgage loan but in reverse. With a traditional mortgage the borrower receives the entire loan.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web With a reverse mortgage the amount the homeowner owes goes upnot downover time. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

After that the premium is 05 of the outstanding loan. Own the property outright or have considerable. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. In this step the lender will begin working on your application. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Once you or your estate. Get A Free Information Kit. A reverse mortgage works.

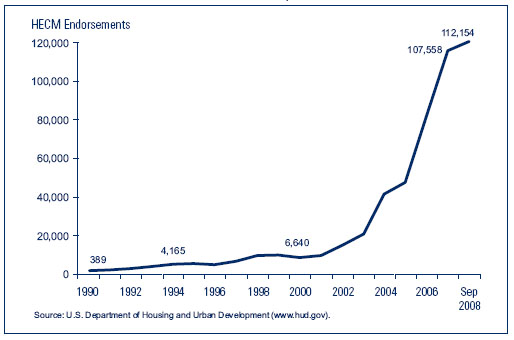

Ad Looking For Reverse Mortgage For Seniors. Web The most common type of reverse mortgage is the HECM or home equity conversion mortgage which can also be used later in life to help fund long-term care. Web A reverse mortgage may be worth considering earlier on in retirement.

Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. Web A key feature of a reverse mortgage is that you can stay in your home and wont have to make repayments to your lender as long as youre living there. Web A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

Web Step 1. The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or.

What Is A Reverse Mortgage And How Does It Work Hecm

Lloyd Kushner Director Of Underwriting Longbridge Financial Llc Linkedin

Reverse Mortgage Line Of Credit 5 Things You Need To Know

Zero Point Mortgage Services Mortgage Brokers You Can Trust

What Is A Reverse Mortgage How Does It Work Arlo

Everything You Need To Know About Reverse Mortgages Bankrate

What Is A Reverse Mortgage And How Do They Work

What Is A Reverse Mortgage How Does It Work Arlo

What Is A Reverse Mortgage Discover How One Works

Reverse Mortgage Calculator

What Is A Reverse Mortgage And How Do They Work

Reverse Mortgages What Consumers And Lenders Should Know

Reverse Mortgage Home Loans Cs Bank Northwest Arkansas Cassville Mo

How Does A Reverse Mortgage Work A Real World Example

285 Hustler 072122 By Colorado Community Media Issuu

How Does A Reverse Mortgage Loan Work It S Not Magic It S Your Home Equity Homeownership Hub

What Is A Reverse Mortgage How Does It Work Arlo