Payroll calculation online

Perk Payroll also relieves Finance teams by generating challans - PF ECR text file for PF and ESI Form MC for ESI PT Form V for professional tax and Form 24Q for TDS calculation. Keka payroll system is affordable scalable with automated compliances.

Payroll Calculator Free Employee Payroll Template For Excel

Leavers on the first day of the next payroll period.

. Once you finish entering employee information the payroll deductions calculator generates a salary calculation result that shows the gross wages federal and provincial deductions CPP and EI. Employee payroll processing is one of the key HR functions in any organization. Ive kept this spreadsheet fairly basic so depending on your business and policies you may find that you need to add more columns.

You may begin using the payroll application at any time during the year. Reads part period parameters. Keka is a one-stop solution for all HR concerns.

We offer free payroll setup to help you get your account set up and can enter all payroll history for you. Automate payroll calculation and taxes generate online pay stubs and pay your employees on time every time. Select the employees you need to pay.

Perk manages the tax calculation once employees fill the tax declaration form on the app. Tax Calculation Filing. Deductions are calculated accordingly and the pay is disbursed on time.

Some states have no income taxes such as Alaska Texas Florida Nevada Washington while other states California New York have a high state income on employee earnings resulting in smaller net. If you had previously given consent to receive your W-2 online it will not be mailed to you unless you withdraw consent. UCPath is the University of Californias system-wide payroll benefits human resources and academic personnel system.

The payroll software solution in Dayforce delivers real-time global visibility efficiency and compliance and eliminates redundant manual processes. If youre interested in a payroll provider check out some of our reviews of companies such as OnPay Gusto and Paychex. Accurate tax liability calculation.

This course gives an overview onuse of SAP for end to end payroll processing. Skip To The Main Content. To understand how the leave encashment is calculated here is an example.

Focus on your business while we track and apply changing tax laws. Continue to create payroll as normal. Other standard deductions like PF PT Income Tax ESIC and LWF auto calculation of TDS in-built TDS Utility etc.

According to the Holidays Act 2003. If the time unit for the payroll area is different to the time unit for the pay scale type and area. Try online payroll today.

If you did not receive your W-2 and prefer not to access it online you can submit a request via email to the Payroll Office. Did you check that your home address listed in the UCPath online portal is correct. Enter the hours of unpaid time off.

And if you need to talk to us - our help we will be. Use this free online payroll calculator to estimate gross pay deductions and net pay for your employeesor yourself. Choosing the right automated payroll software is important to get the best value for your investment in this system which is a must-have for all types of.

All 50 states and multi-state. You can do your payroll online or on the go with the help of our mobile payroll apps to get your job done. Reads part period parameters.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Requesting a Duplicate Copy. HLB Bahrain Payroll Team.

Download free demo of the Gen Desktop Payroll Software today which serves as a free payroll software India. Select your desired payroll schedule then Continue. SurePayroll is a Small Business Payroll Company providing Easy Online Payroll Services such as Payroll Tax Services Accounting Services and 401k Plans.

Update your address online through your HR Pay account. New joiners during payroll period. Run your first payroll in 10 minutes.

Then select Adjust salary this time only. The calculation for Holiday Pay is at a flat rate of 8 of the Gross Earnings. It also works as a free payroll software for small business in India allowing them to manage their day-to-day.

The new form will become available on September 1st and can be accessed from the forms page on the Payroll Tax website or the Payroll Tax section of the RaiderlinkWebRaider portal. You will want to make sure you enter all of your employee payroll history in the software so end-of-the-year W2s are accurate. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Free 2022 Employee Payroll Deductions Calculator. With Dayforces continuous calculation technology your employees can access up to 100 of their net earnings while accounting for applicable taxes and deductions. What should I know.

Paycheck Calculator is a great payroll calculation tool that can be used to compare net pay amounts after payroll taxes in different states. Go to Payroll then Employees. If you dont think the calculation is correct contact the Ecotime team by submitting a ticket to UCPath Support.

Mrs Shanaya is retiring after 20 years of service. The holiday pay is accrued during the year and only applied to a final pay if the. Leave encashment calculation.

Zoho Payroll is online payroll software thats designed for federal and state tax compliance. Simple stress-free payroll for your growing business. MYOB Payroll calculates the annual leave rate in accordance with the Holidays Act 2003.

Payroll is a process to calculate the salary and wages of permanent and temporary employees of an organization. Online payroll for small business that is simple accurate and affordable. Very similar in the calculation as Social Security tax Medicare deducts 145 of the employees taxable.

Payroll Tax Services is excited to announce a new online Lump Sum Vacation Certification form. Payroll is a sub-module of SAP HCM. Report payroll and pay premiums online.

Bahrain End of Service Gratuity Calculation. Payroll calculation and processing Payroll Direct Deposit Federal and State electronic tax payments Check printing Check signing Elecronic Filing of W21099 and quarterly reports. Gratuity calculation Less than3 years.

Select the salary amount of the employee you want to adjust. She was entitled to 25 days of paid leave per annum from her company meaning she had 500 days of leave during her entire service to the company. To make payroll calculations simple quick and error-free companies are using advanced payroll software systems that can automate salary calculations and take care of payroll compliances.

The calculation for excess earnings is included in Step 1 of the Annual Payroll Report employers are required to submit each year. Reads part period parameters. 15 days wage for each of the first three years of employment 3 years and Above.

The 8 roughly equals four weeks of annual leave. Heres an example of a gross-pay calculation. Our enhanced employer online services are the easiest and most convenient way for you to report payroll pay premiums and more.

Kekas cloud-based payroll management system enables organizations not only a smooth migration but also easy integration with attendance and leave so as to ensure proper calculation of payroll and taxes.

Payroll Formula Step By Step Calculation With Examples

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Salary Formula Calculate Salary Calculator Excel Template

Payroll Formula Step By Step Calculation With Examples

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Pin On Raj Excel

15 Free Payroll Templates Smartsheet

How To Calculate Net Pay Step By Step Example

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Calculator Free Employee Payroll Template For Excel

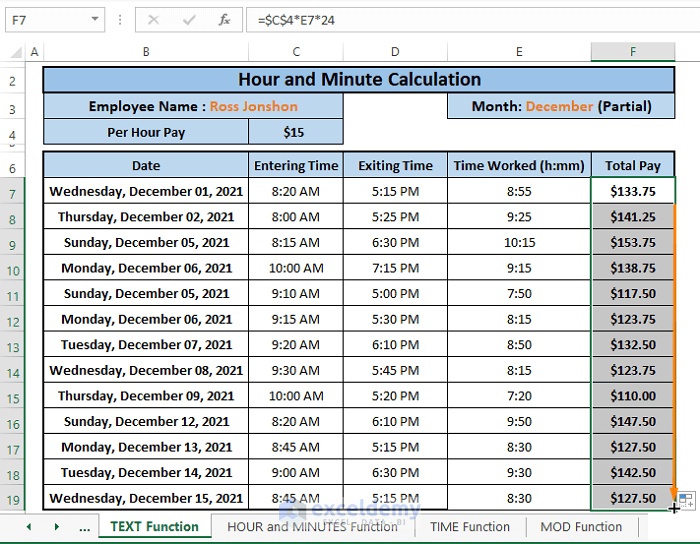

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Salary Formula Calculate Salary Calculator Excel Template

Payroll Calculator Free Employee Payroll Template For Excel